Yes, you’ve heard about the tariffs…

But what else is impacting the pulp and paper industry this year?

Key Trends in 2025

Stabilization, with Diverging Segment Growth

After significant turbulence in 2023 and partial recovery in 2024, the industry is stabilizing in 2025, with packaging grades (especially for e-commerce and food sectors) driving global demand.

Surge in Sustainable Packaging

Sustainability remains the top market driver. The use of alternative fibers like bamboo, hemp, and agricultural residues is increasing, reducing reliance on traditional wood pulp and meeting regulatory and consumer pressure for biodegradable packaging.

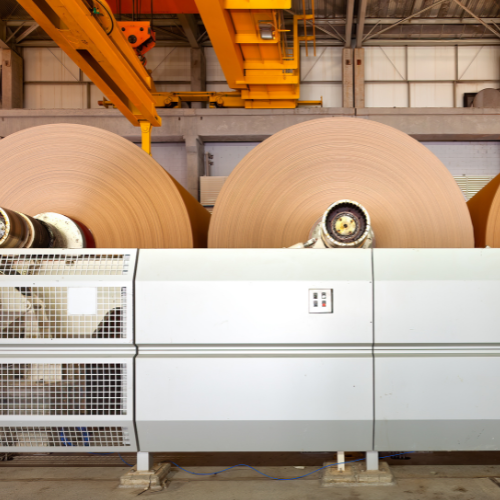

Tech Innovation and Smart Manufacturing

Mills worldwide are leveraging IoT sensors, automation, and artificial intelligence to enhance resource management, improve process efficiency, and enable data-driven maintenance. These advances are reducing labor demands and driving smarter, more flexible factories. At Scanpap, we went on a recent trip to a principal mill in Malaysia to understand how automation is not only improving the consistency of their products, but also helping to cut unnecessary manpower costs.

Circular Economy & Advanced Recycling

The industry is investing in smarter recycling—including enzyme-based de-inking and closed-loop water/energy systems—to boost recycled content and minimize waste. Enhanced recycled pulp quality, driven by AI in sorting, supports this shift toward a circular economy.

Regional Dynamics and Market Growth

While European and American mills respond to reduced local consumption and tighter margins by diversifying product lines and consolidating, China continues to show growth in both uncoated wood-free (UWF) paper and packaging demand, impacting global capacity and pricing.

“China is the largest consumer of market pulp. It accounts for more of the global market pulp demand than Europe, North America and Latin America combined. As a result, consumer confidence in the region is a major factor in the global landscape.

This lower demand has led to a 7% year-on-year decrease in imports into the market, in part due to the industry’s shift to wood chip production. The cost to produce hardwood pulp in China is now above imported BHK prices, reducing demand for market pulp and benefiting integrated producers.

In 2025, the market could begin to recover as the benefits from the government’s stimulus package take shape. The policies are aimed at improving domestic consumption, which could further fuel a restocking rally for pulp and paper consumption.”

(Market Sentiment showing signs of recovery: Global Pulp Outlook, 2025 Preview, Fastmarkets, March 14, 2025)

Trade and Regulatory Changes

New tariffs and trade barriers, particularly between North America, Europe, and Asia, affect exports, drive strategic investments, and reshape supply chains. Increasingly stringent regulatory frameworks also require greater transparency in sourcing and sustainability reporting.